In the fast-paced world of Forex trading, the advent of technology has brought about significant changes, one of which is the development of Forex trading bots. These automated trading systems can analyze market data and execute trades with little to no human intervention. In this article, we will explore the functionality, advantages, and challenges associated with Forex trading bots. If you’re looking for reliable brokers to begin your trading journey, check out forex trading bot Trusted Trading Brokers.

What is a Forex Trading Bot?

A Forex trading bot, also known as an automated trading system, is a software program that trades on behalf of a trader in the foreign exchange market. It utilizes algorithms and predefined rules to make trading decisions. Bots can analyze price data, identify trends, and execute trades automatically, ensuring that traders can capitalize on market movements without manual intervention.

How Do Forex Trading Bots Work?

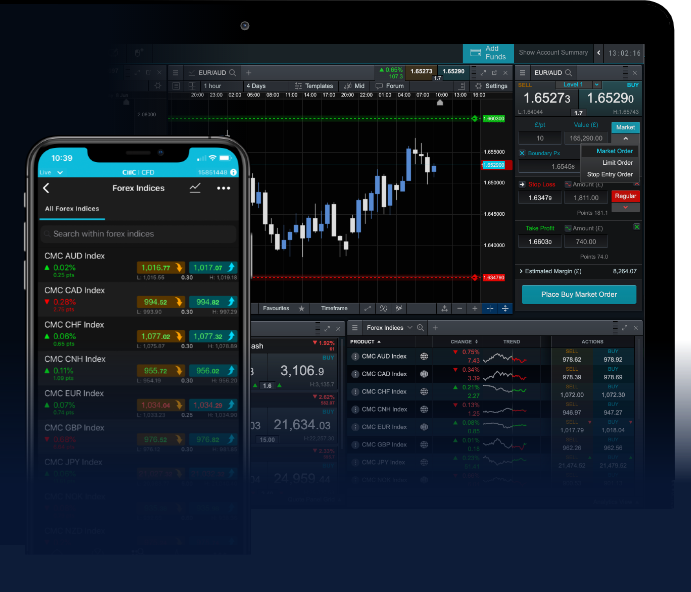

Forex trading bots operate based on algorithms that interpret market data and generate trading signals. They can be deployed on various platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), where they continuously monitor currency pairs for trading opportunities. When a bot identifies a favorable trading signal, it will automatically execute a trade according to the trader’s predefined parameters.

The functionality of a Forex trading bot typically relies on technical analysis indicators, price action analysis, and specific trading strategies programmed into the system. These parameters dictate when to buy or sell a currency pair, manage risk, and execute trades based on market conditions.

Advantages of Using Forex Trading Bots

1. Emotionless Trading

One of the primary advantages of using Forex trading bots is their ability to perform trades without emotional bias. Traders often struggle with emotions such as fear and greed, which can lead to poor decision-making. Bots, on the other hand, execute trades based solely on logic and pre-set criteria, eliminating emotional disturbances.

2. 24/7 Market Monitoring

The forex market operates 24 hours a day, making it challenging for traders to monitor their positions constantly. Forex trading bots can run around the clock, analyzing market data and executing trades without the need for constant human supervision. This continuous monitoring increases the chances of capturing profitable opportunities.

3. Backtesting Capabilities

Forex trading bots allow traders to backtest their strategies using historical data. This feature enables traders to assess the effectiveness and profitability of their trading strategies before risking real money. By running simulations, traders can refine their trading methods and make informed decisions about their approach.

4. Speed and Accuracy

Trading bots can execute trades at lightning speed, capitalizing on price movements before they can be perceived by human traders. This speed can be crucial in the volatile forex market, where prices can change within seconds. Furthermore, bots are designed to minimize execution errors, ensuring trades are placed accurately according to the predetermined strategy.

Challenges of Using Forex Trading Bots

1. Market Unpredictability

While Forex trading bots are designed to analyze data and execute trades based on algorithms, the market is inherently unpredictable. Sudden news events, economic announcements, and geopolitical developments can lead to market movements that may not be captured by historical data. Therefore, although bots can enhance trading efficiency, they are not foolproof and can incur losses.

2. Technical Issues

Forex trading bots depend on technology and internet connectivity. Issues such as server downtimes, software glitches, or connectivity problems can hinder a bot’s performance. Traders must ensure that the trading platform used is reliable and that the bot is properly configured to avoid technical pitfalls.

3. Over-Optimization

Many traders make the mistake of over-optimizing their trading bots for past performance, which can lead to poor results in live trading conditions. This phenomenon, known as curve fitting, occurs when a bot is too finely tuned to historical data, resulting in a strategy that does not perform well when subjected to real market fluctuations.

Choosing the Right Forex Trading Bot

When selecting a Forex trading bot, traders should consider various factors:

- Performance History: Review the bot’s historical performance, taking into account the win-loss ratio and drawdown metrics.

- Customizability: Choose a bot that allows you to customize settings and strategies to suit your trading style.

- Customer Support: Reliable customer support is essential for addressing issues or queries regarding the bot’s functionality.

- Community Feedback: Look for user reviews and feedback from other traders to gauge the bot’s effectiveness and reliability.

Conclusion

Forex trading bots can be powerful tools for traders seeking to enhance their profitability and trading efficiency. By automating trading strategies, these systems can reduce emotional bias, allow for continuous market monitoring, and execute trades with precision. However, it is essential to understand the risks and challenges associated with automated trading. Careful consideration when choosing a bot and regular monitoring of its performance can lead to a successful trading experience.

wordpress theme by initheme.com